kansas sales tax exemption form pdf

Get Access to the Largest Online Library of Legal Forms for Any State. Sign the form using our drawing tool.

School Odh 216a Certificate Of Exemption Https Www Ok Gov Health2 Documents Imm School Odh 216a Certificate Of Exemp Child Care Facility School Kids School

Businesses with a general understanding of Kansas sales tax rules and regulations can avoid costly errors.

. SalesTaxHandbook has an additional three. Not all states allow all exemptions listed on this form. Ov for additional information.

The new certificates have an expiration date of October 1 2020. Street RR or P. Is exempt from Kansas sales and compensating use tax for the following reason.

Kansas Sales Use Tax for the Agricultural Industry at. ST-28F Agricultural Exemption Certificate Rev 12-21 Author. Fill in and edit forms.

To apply for update and print a sales and use tax exemption certificate. Street RR or P. The renewal process will be available after June 16th.

Sales and Use Tax Refund. This ia a Contractor Sales Tax Certificate which is a special type of certificate intended for use by contractors who are purchasing goods or tools that will be used in a project contracted by a tax-exempt entity like a government agency or tax-exempt nonprofitThe contractor must certify that the goods being purchased tax-free are exclusively for use on the tax-exempt entitys contract. Is exempt from Kansas sales and compensating use tax for the following reason.

KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or services purchased from. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. KANSAS SALES AND USE TAX REFUND APPLICATION.

Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at. As a registered retailer or consumer you will receive updates from the Kansas Department of Revenue when changes are made in the laws governing sales and use tax exemptions. The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose that is not exempt.

Send to someone else to fill in. The seller may be required to provide this. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax AgreementPlease note that Kansas may have specific restrictions on how exactly this form can be used.

Keep these notices with this booklet for future reference. 79-3606n you must include a factual statement of usage along with exemption reason. Fill in your choosen form.

Questions would be directed to Taxpayer Assistance at 785-368-8222. Download or print completed PDF. It explains the exemptions currently authorized by Kansas law and includes the exemption certificates to use.

For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at. How to use sales tax exemption certificates in Kansas. This booklet is designed to help businesses properly use Kansas sales and use tax exemption certificates as buyers and as sellers.

Contractor Retailer Exemption ST-28W Rev. Box City State Zip 4. Sales and Use Tax Entity Exemption Certificate.

79-3606n exempts all sales of tangible personal property consumed in the production manufacture processing mining drilling refining or compounding of tangible personal property the treatment of waste or by-. Fill has a huge library of thousands of forms all set up to be filled in easily and signed. You may also obtain the.

Reason for Exemption For requests under KSA. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Exemptiuon Certificates ST-28W Contractor Retailer Exemption Created Date.

Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. The certificate is to be presented by tax exempt entities to retailers to purchase goods andor services tax exempt from sales and use tax. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

HOWEVER if the inventory item purchased by an out-of-state retailer who has sales tax nexus with Kansas is drop shipped to a Kansas location the out-of-state retailer must provide. The company can claim either the 15 percent credit or up to the 1125 percent whichever is less. Box City State Zip 4 _____ is exempt from Kansas sales and compensating use tax for the following reason.

Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. Ad The Leading Online Publisher of National and State-specific Legal Documents. HOWEVER if the inventory item purchased by an out-of-state retailer who has sales tax nexus with Kansas is drop shipped to a Kansas location the out-of-state retailer must provide.

Sales Tax Entity Exemption Certificate Renewal On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire. Form used to apply for a sales and use tax refund Keywords. Streamlined Sales and Use Tax Agreement Certificate of Exemption Kansas This is a multi-state form.

Is exempt from Kansas sales and compensating use tax for the following reason. The certificates will need to be renewed on the departments website. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from.

_____ Business Name. Kansas law KSA 40-252d provides for a tax credit for insurance companies equal to 15 percent of Kansas-based employees salaries or up to a maximum of 1125 percent of taxable premiums dependent on the companys affiliation. Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory.

The following entities and organizations are exempt and issued a Tax Exempt Entity Certificate from the Kansas Department of Revenue. Revenues basic sales tax publication KS-1510 Kansas Sales and Compensating Use Tax. Other Kansas Sales Tax Certificates.

Resale Certificate Request Letter Template 11 Templates Example Templates Example Letter Templates Certificate Templates Business Plan Template

Application For Hospital Sales Tax Exemption Tax Exemption Illinois Sales Tax

Application For Hospital Sales Tax Exemption Tax Exemption Illinois Sales Tax

Printable W 9 Forms Blank 2020 Fillable Forms Blank Form Irs Forms

Costco Tax Exempt Fill Out And Sign Printable Pdf Intended For Best Resale Certificat Letter Templates Letter Templates Free Certificate Of Completion Template

Sample Letter Requesting Sales Tax Exemption Certificate Regarding Resale Certificate Cover Letter For Resume Teacher Resume Examples Resume Objective Examples

Illinois Quit Claim Deed Form Quites Illinois The Deed

Printable W 9 Forms Blank 2020 Fillable Forms Blank Form Irs Forms

What Is A Homestead Exemption Protecting The Value Of Your Home Homesteading What Is Homestead Property Tax

Wyoming Quit Claim Deed Form Quites The Deed Wyoming

What Is Form W 4 Tax Forms Job Application Form The Motley Fool

Reg 256 Fillable Forms Facts Tax Exemption

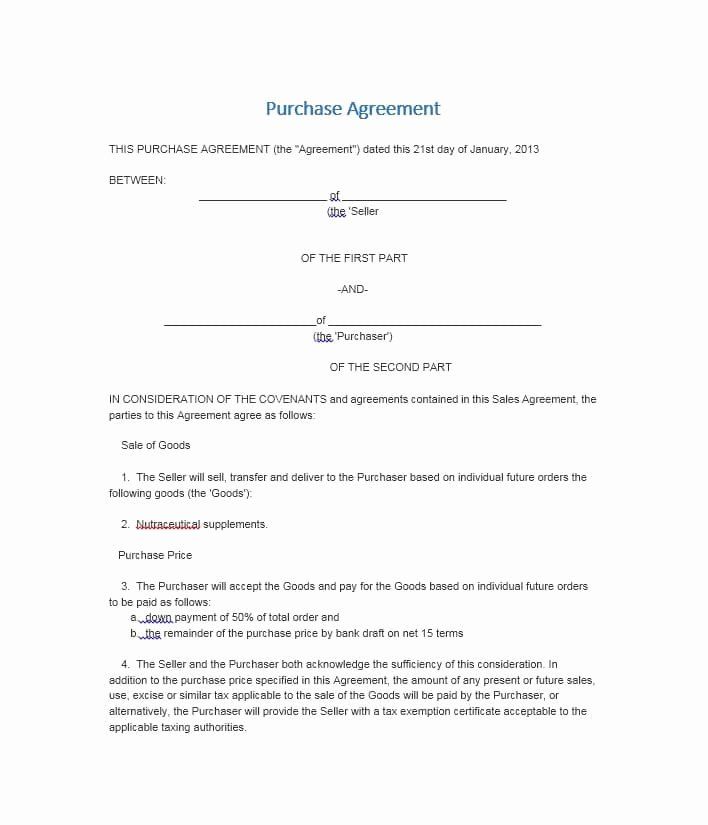

Business Sale Contract Template Luxury 37 Simple Purchase Agreement Templates Real Estate Business Contract Template Purchase Agreement Purchase Contract

Name Reservation Request Form How To Create A Name Reservation Request Form Download This Name Reservation Request Form T Form Planner Printables Free Names

Resale Certificate Request Letter Template 3 Templates Example Templates Example Letter Templates Certificate Templates Lettering

Pdf Doc Free Premium Templates Resignation Letters Letter Templates Resignation Letter

Resale Certificate Request Letter Template 5 Templates Example Templates Example Letter Templates Lettering Certificate Templates